Right direction for the country, Mbadi defends Safaricom stake sale

Source: The Standard

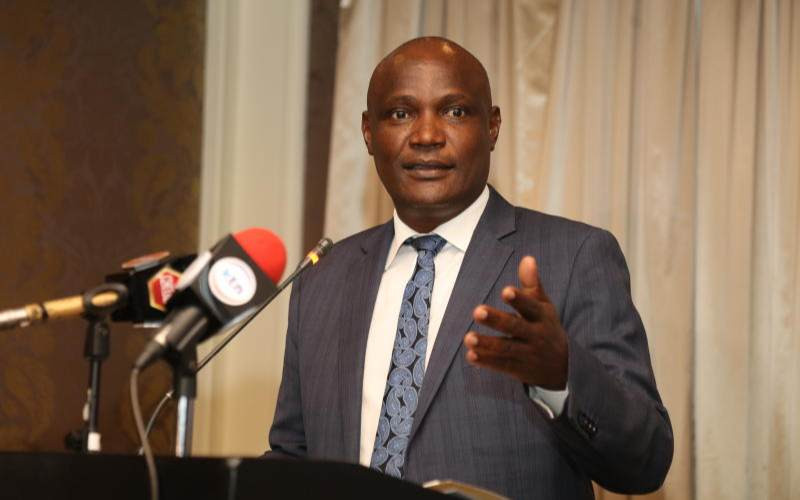

John Mbadi Cabinet Secretary The National Treasury and Economic Planning speaking during 2025/2026 Deloitte Kenya National Budget Analysis. [Wilberforce Okwiri, Standard]

National Treasury Cabinet Secretary John Mbadi has defended the government's plan to sell 15 per cent of its 35 per centSafaricom stake for Sh204.3 billion, dismissing concerns over valuation and positioning the move as critical infrastructure financing.Speaking during a television interview on Friday, December 5, Mbadi described the transaction as "unlocking value of a mature asset" and rejected claims the proceeds would plug budget deficits."This is the right direction that this country needs to take. We need some bold decision where we are not in a very comfortable position in terms of the economy, and something needs to be done," Mbadi said.Follow The Standard

channel

on WhatsAppThe sale would lift Vodacom's stake to 55 per cent, crossing the regulatory threshold for effective control. Vodacom currently holds 40 per cent, the government 35 and the public 25.Mbadi said proceeds would support the NationalInfrastructure Fund and the SovereignWealth Fund to finance public projects nationwide."We are not selling Safaricom shares to meet short-term budget deficits. We are not taking this money to finance our budget in the ordinary sense of it," he noted.The transaction follows four stages: proposal initiation, approval, execution and reporting.A public notice on Tuesday outlined the deal, which includes internal restructuring within Vodafone and Vodacom Group. Vodafone will take formal control after the share transaction.However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

Speaking during a television interview on Friday, December 5, Mbadi described the transaction as "unlocking value of a mature asset" and rejected claims the proceeds would plug budget deficits."This is the right direction that this country needs to take. We need some bold decision where we are not in a very comfortable position in terms of the economy, and something needs to be done," Mbadi said.Follow The Standard

channel

on WhatsAppThe sale would lift Vodacom's stake to 55 per cent, crossing the regulatory threshold for effective control. Vodacom currently holds 40 per cent, the government 35 and the public 25.Mbadi said proceeds would support the NationalInfrastructure Fund and the SovereignWealth Fund to finance public projects nationwide."We are not selling Safaricom shares to meet short-term budget deficits. We are not taking this money to finance our budget in the ordinary sense of it," he noted.The transaction follows four stages: proposal initiation, approval, execution and reporting.A public notice on Tuesday outlined the deal, which includes internal restructuring within Vodafone and Vodacom Group. Vodafone will take formal control after the share transaction.However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

"This is the right direction that this country needs to take. We need some bold decision where we are not in a very comfortable position in terms of the economy, and something needs to be done," Mbadi said.Follow The Standard

channel

on WhatsAppThe sale would lift Vodacom's stake to 55 per cent, crossing the regulatory threshold for effective control. Vodacom currently holds 40 per cent, the government 35 and the public 25.Mbadi said proceeds would support the NationalInfrastructure Fund and the SovereignWealth Fund to finance public projects nationwide."We are not selling Safaricom shares to meet short-term budget deficits. We are not taking this money to finance our budget in the ordinary sense of it," he noted.The transaction follows four stages: proposal initiation, approval, execution and reporting.A public notice on Tuesday outlined the deal, which includes internal restructuring within Vodafone and Vodacom Group. Vodafone will take formal control after the share transaction.However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

The sale would lift Vodacom's stake to 55 per cent, crossing the regulatory threshold for effective control. Vodacom currently holds 40 per cent, the government 35 and the public 25.Mbadi said proceeds would support the NationalInfrastructure Fund and the SovereignWealth Fund to finance public projects nationwide."We are not selling Safaricom shares to meet short-term budget deficits. We are not taking this money to finance our budget in the ordinary sense of it," he noted.The transaction follows four stages: proposal initiation, approval, execution and reporting.A public notice on Tuesday outlined the deal, which includes internal restructuring within Vodafone and Vodacom Group. Vodafone will take formal control after the share transaction.However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

Mbadi said proceeds would support the NationalInfrastructure Fund and the SovereignWealth Fund to finance public projects nationwide."We are not selling Safaricom shares to meet short-term budget deficits. We are not taking this money to finance our budget in the ordinary sense of it," he noted.The transaction follows four stages: proposal initiation, approval, execution and reporting.A public notice on Tuesday outlined the deal, which includes internal restructuring within Vodafone and Vodacom Group. Vodafone will take formal control after the share transaction.However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

"We are not selling Safaricom shares to meet short-term budget deficits. We are not taking this money to finance our budget in the ordinary sense of it," he noted.The transaction follows four stages: proposal initiation, approval, execution and reporting.A public notice on Tuesday outlined the deal, which includes internal restructuring within Vodafone and Vodacom Group. Vodafone will take formal control after the share transaction.However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

The transaction follows four stages: proposal initiation, approval, execution and reporting.A public notice on Tuesday outlined the deal, which includes internal restructuring within Vodafone and Vodacom Group. Vodafone will take formal control after the share transaction.However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

A public notice on Tuesday outlined the deal, which includes internal restructuring within Vodafone and Vodacom Group. Vodafone will take formal control after the share transaction.However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

However, Kiharu MP Nyoro has challenged the sale, accusing the government of undervaluation and lack of competitive bidding."There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

"There was no competitive bidding. How did they set the price, and how did they pick Vodacom as the buyer?" Nyoro told reporters in Nairobi on Thursday, December 4.The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

The former Budget and Appropriations Committee member questioned the pricing, saying the government risks short-changing taxpayers."We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

"We cannot sell a share at Sh34 unless there has been a deliberate suppression of the valuation. The government is underselling the stake at the detriment of Kenyans," Nyoro added.Stay informed. Subscribe to our newsletterBy clicking on theSIGN UPbutton, you agree to ourTerms & Conditionsand thePrivacy PolicySIGN UP

Subscribe to our newsletter and stay updated on the latest developments and special

offers!

Pick your favourite topics below for a tailor made homepage just for you